Rocks and hard places. exopixel

Rocks and hard places. exopixel

Inflation among the 37 member states of the Organisation for Economic Co-operation and Development (OECD) fell from 2.3% in February to 1.7% in March. With all the damage to global health and economies inflicted by COVID-19, this is one “collapse” that might sound like good news. After such widespread loss of jobs and incomes, the last thing anyone needs right now is goods getting more expensive.

However, there are dangers in further reducing the already low rate of consumer price inflation. In many countries, it is already below the level targeted by their central banks – 2% in the US, eurozone and the UK. Price rises are being stemmed by the fall in demand caused by the pandemic, plus the steep decline in the price of oil. A slowdown of inflation towards zero or even into negative territory – deflation – will bring new economic concerns, potentially turning recession into depression.

Deflationary downsides

Consumer spending is the major component of the demand that drives an economy. If people start to think prices are going to fall, they tend to put off non-essential purchases in the hope things will cost less in months to come. Although falling prices mean a real income gain for those whose pay hasn’t been affected by the current crisis, for many others this will be outweighed by the income they have lost from being furloughed or from being forced onto state benefits.

Deflation happened in the early 1930s and also in the 1870s, and when it showed signs of returning in 2008, central banks responded by cutting interest rates and printing money. The fact that this has continued for much of the past decade reflects economists’ growing belief that factors ranging from automation and household debt to rising inequality and the ageing population have hardwired low demand into the system.

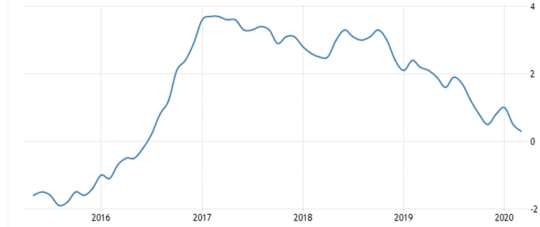

Slack demand pressures firms to cut prices and then pare their costs by reducing jobs and wages, compounding the deflationary problem. Many were already struggling to grow their sales even before the pandemic, and won’t be able to cut their prices much further without sacrificing profits. UK producer price rises slowed to just 0.3% in March, even before the lockdown began to rein in people’s spending. Lower profit would squeeze their ability to finance investment, chopping another component of demand.

UK producer price growth

As well as damaging demand, falling prices also raise the real cost of debt. If you borrow £1,000 and annual inflation is running at 3%, the money you owe becomes worth 3% less each year even before you pay anything off. If there’s 3% deflation, the debt becomes worth 3% more each year in real terms. In a world with record levels of debt, this could become a very serious problem.

In the current crisis, central banks around the world have been trying to boost consumer demand and help businesses survive by cutting interest rates to close to zero. Deflation would frustrate this effort: whereas 3% inflation annuls the real cost of a loan that charges 3% interest, a 3% deflation means a real interest rate of around 6%.

When interest rates are driven down to what economists call their zero lower bound, governments trying to revive their economies are forced to seek other ways to lighten people’s debts and boost spending power. These include underwriting private sector debt; giving companies and individuals temporary protection from bankruptcy or insolvency; and, in the US, directly paying money into people’s accounts in the hope that they’ll spend it.

Will inflation return?

Inflation has slowed even when some products are in short supply due to industrial stoppages and panic buying. Past experience has made many retailers reluctant to raise prices in case it looks like profiteering. Shoppers who ventured online (or into lay-bys) in search of missing essentials reported re-sellers charging huge premiums, which the official inflation index does not capture.

Prices will start to rise again if supply can’t keep up with the demand that’s now being injected into the world’s economies in the form of government stimulus measures to fight recession. This could lead to significant inflation in the next year or two if there’s renewed demand while global supply chains remain disrupted. And it will be aggravated if oil prices rebound sharply from recent 20-year lows.

If inflation does soar, it will have been fuelled by the extraordinary scale of government borrowing in response to the shutdowns. The US government will borrow more in the present quarter than in the whole of 2019, extending what was already a trillion-dollar budget deficit. The UK’s business-support costs have already reached £100 billion, far more than the bank bailouts of 2007-09.

Fiscally stronger countries like the US are financing much of the increase spending by issuing new public debt, which in principle absorbs some demand and reduces any inflation pressure. But other governments, including the UK, may literally print some of the additional money.

Policymakers are rediscovering the Keynesian thinking that deficits will create enough economic growth to prevent the public debt-to-GDP ratio from getting out of hand. Some have also embraced the once fringe idea of modern monetary theory, which argues that any country with its own currency can increase spending by printing money rather than having to increase taxation or take on more debt.

Before these views edged into the mainstream, the dominant “monetarist” narrative was that increasing the money supply by running large fiscal deficits was bound to ratchet inflation. Some monetarists viewed this as secretly part of a political plan. Governments, they argued, invariably run up debts and don’t want to repay them by raising people’s taxes. Instead they unleash inflation, which makes these debts worth less while also “taxing” the value of people’s wealth.

Today’s governments will certainly hope that their fiscal and monetary stimulus packages cause some further increase in prices, as well as averting falls in income and industrial capacity. Because whatever the downsides of inflation, the prospect of deflation in a world with such high debts is considerably worse.![]()

About The Author

Alan Shipman, Lecturer in Economics, The Open University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Recommended books:

Capital in the Twenty-First Century

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.

Nature's Fortune: How Business and Society Thrive by Investing in Nature

by Mark R. Tercek and Jonathan S. Adams.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

Click here for more info and/or to order this book on Amazon.

Beyond Outrage: What has gone wrong with our economy and our democracy, and how to fix it -- by Robert B. Reich

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

Click here for more info or to order this book on Amazon.

This Changes Everything: Occupy Wall Street and the 99% Movement

by Sarah van Gelder and staff of YES! Magazine.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

Click here for more info and/or to order this book on Amazon.