The United States has had many periods of moderate inflation, punctuated by hyperinflation and deflation, each profoundly impacting the economy and society. During the 20th century, the United States experienced significant inflationary periods, especially during and after major wars, such as World War I and II. In the post-war periods, the economy often overheated due to increased government spending and high demand for goods, leading to inflation.

The most notable period of inflation occurred in the 1970s and early 1980s, a time characterized by stagflation - a situation of stagnant economic growth and high inflation. During this period, inflation peaked at 13.5% in 1980, primarily driven by oil price shocks and loose monetary policy. In response, under the chairmanship of Paul Volcker, the Federal Reserve tightened monetary policy significantly, leading to a severe recession.

Since the 1980s, inflation in the United States has been relatively low and stable, mainly due to changes in monetary policy and a greater understanding of inflation dynamics. The Federal Reserve has adopted an inflation target of 2%, viewing that rate as consistent with healthy economic growth. However, the aftermath of the 2008 financial crisis and, more recently, the COVID-19 pandemic have presented new inflationary challenges, sparking debates on the appropriate targets and measures to manage inflation in the 21st century.

The Federal Reserve's Daunting Task

The Federal Reserve inflation target of 2% was not only aimed at maintaining price stability but also at promoting maximum employment. However, the Fed has recently introduced a new approach to its monetary policy, dubbed the "average inflation targeting" framework. This new framework aims to achieve price stability and maximum employment by allowing inflation to run moderately above 2% for some time following periods when it has been running below 2%.

The task of the Federal Reserve has been daunting, to say the least, given the challenging circumstances in recent times:

Tight Labor Market

The tightness in the labor market can be attributed to significant demographic changes in recent years. One key factor is the dramatic decline in the birth rate, since the baby boom era after WWII, resulting in a smaller pool of individuals entering the workforce. With fewer young individuals joining the labor market, the available labor supply is constrained.

Additionally, the slowdown in immigration due to anti-immigration policies has further exacerbated the situation. Historically, immigrants have played a crucial role in filling labor gaps and contributing to workforce growth. These demographic shifts highlight the challenges faced in sourcing an adequate labor supply, which has implications for businesses, economic growth, and inflation.

Supply Chain Disruptions

Years of neoliberal policies prioritizing outsourcing and implementing just-in-time inventory practices, combined with the global pandemic, have created a perfect storm leading to supply chain disruptions and inflationary pressures. The emphasis on cost-cutting and efficiency in manufacturing, driven by neoliberal policies, resulted in the hollowing out of domestic manufacturing capabilities. This overreliance on global supply chains left industries vulnerable when the pandemic hit, causing disruptions in production and distribution.

The pandemic-induced lockdowns and restrictions further exacerbated supply problems, with factories shutting down and disrupted transportation networks. These supply chain disruptions and increased demand for certain goods and materials led to supply shortages and higher production costs, ultimately contributing to inflationary pressures. The convergence of these factors highlights the complex interplay between economic policies, global events, and their impact on supply and inflation.

Failure To Budget Properly

The failure to adequately invest in infrastructure spending over the past four decades has reached a critical point, necessitating increased expenditure. The lack of sufficient investment in infrastructure projects has led to a backlog of maintenance and repairs, causing a deterioration in the overall quality of public infrastructure.

The sudden surge in infrastructure spending, coupled with the inadequate spread of expenditures over time, has generated inflationary pressures. This highlights the consequences of delayed infrastructure spending and the importance of strategic planning and gradual implementation to mitigate the impact on prices and inflation.

Curb Expectation of Higher Prices Ahead

The most significant risk with inflation is in the expectations held by both consumers and businesses regarding future purchases and pricing. Reporting inflation year-over-year (long-term) rather than month-by-month (short-term) can contribute to a misleading perception of the actual inflationary trends. This can result in distorted expectations among consumers and businesses alike. When inflation is reported annually, it may not accurately reflect the month-to-month price fluctuations, leading to misinformed decision-making. Consequently, if consumers and businesses base their purchasing and pricing decisions on these skewed expectations, it can fuel inflation.

The recent decision by the Federal Reserve (Fed) to pause the interest rate increase for the current month while indicating the possibility of future increases can be seen as an attempt to manage inflation expectations. This jawboning approach is necessary as the media generally fails to report inflation news accurately.

How The Media Encourages Future Inflation

During periods of higher inflation, such as those experienced in 2022, the way inflation data is presented and interpreted by politicians and the media can significantly shape public perception and, in turn, price expectations. When inflation is reported on a year-over-year basis, it can often paint a picture of persistent and high inflation, mainly if the base period (the previous year) was characterized by low prices, such as during a recession or a period of deflation. While this approach offers a long-term perspective on price changes, it can sometimes give a misleading impression of the current inflationary trend, particularly if inflation is beginning to subside.

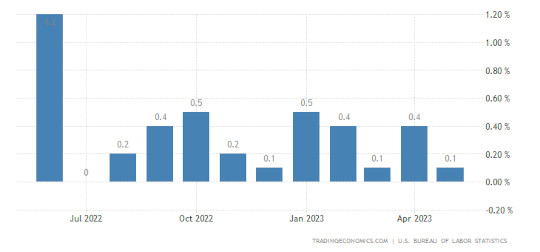

On the other hand, month-over-month inflation figures can provide a more current snapshot of the inflation situation, capturing recent changes that might not be as visible in year-over-year figures. If inflation rates are beginning to decline, this will be more immediately evident in month-over-month data. However, when the media and politicians do not report or emphasize these month-over-month figures, the public may continue to believe that inflation is persistently high, feeding into inflation expectations and potentially exacerbating the situation.

Inflation fell significantly starting 11 months ago. The average person would be unaware as the media failed to report the dramatic decline.

Therefore, it is essential for those communicating inflation data to the public to present a balanced view, incorporating both short-term (month-over-month) and long-term (year-over-year) perspectives. This approach can help the public better understand inflation dynamics, reducing the risk of misinformation and unnecessary panic and ultimately contributing to more stable price expectations.

This report was aired and posted in June 2023. A bit late, but better than never.

About the Author

Robert Jennings is co-publisher of InnerSelf.com with his wife Marie T Russell. He attended the University of Florida, Southern Technical Institute, and the University of Central Florida with studies in real estate, urban development, finance, architectural engineering, and elementary education. He was a member of the US Marine Corps and The US Army having commanded a field artillery battery in Germany. He worked in real estate finance, construction and development for 25 years before starting InnerSelf.com in 1996.

Robert Jennings is co-publisher of InnerSelf.com with his wife Marie T Russell. He attended the University of Florida, Southern Technical Institute, and the University of Central Florida with studies in real estate, urban development, finance, architectural engineering, and elementary education. He was a member of the US Marine Corps and The US Army having commanded a field artillery battery in Germany. He worked in real estate finance, construction and development for 25 years before starting InnerSelf.com in 1996.

InnerSelf is dedicated to sharing information that allows people to make educated and insightful choices in their personal life, for the good of the commons, and for the well-being of the planet. InnerSelf Magazine is in its 30+year of publication in either print (1984-1995) or online as InnerSelf.com. Please support our work.

Creative Commons 4.0

This article is licensed under a Creative Commons Attribution-Share Alike 4.0 License. Attribute the author Robert Jennings, InnerSelf.com. Link back to the article This article originally appeared on InnerSelf.com

Recommended books:

Capital in the Twenty-First Century

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.

Nature's Fortune: How Business and Society Thrive by Investing in Nature

by Mark R. Tercek and Jonathan S. Adams.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

Click here for more info and/or to order this book on Amazon.

Beyond Outrage: What has gone wrong with our economy and our democracy, and how to fix it -- by Robert B. Reich

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

Click here for more info or to order this book on Amazon.

This Changes Everything: Occupy Wall Street and the 99% Movement

by Sarah van Gelder and staff of YES! Magazine.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

Click here for more info and/or to order this book on Amazon.