Reading the runes. Shutterstock.com

Reading the runes. Shutterstock.com

Financial markets can tell us a lot about the economic recovery ahead, based on their direction of travel and how confident investors feel about the future. This is important as we emerge from the COVID-19 pandemic. There is much debate about whether the economic recovery will be a V-shape, indicating a short-lived economic downturn with a quick return to previous levels of output. Or if the recovery will take longer, following a U-shape. Or it could be more like an L-shape, with no near-term recovery and ultimately taking many years or even decades.

Gold prices have hit a record high. This indicates how worried investors are about the economic recovery. But the signs aren’t all bad. A look at five important indicators reveals a mix of all three recovery shapes and shows that financial markets are uncertain about the economic recovery ahead.

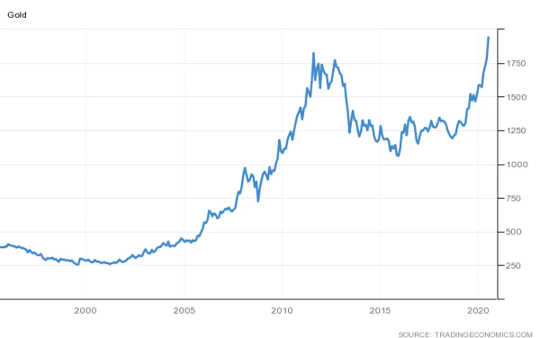

1. Gold

Gold as store of value is seen as a safe asset. As gold does not produce any income in terms of dividends or interest payments it is shunned during good times (when stocks are in favour). But its intrinsic value comes to the fore during times of economic difficulty when gold prices go up.

Gold prices. Trading Economics

Gold prices. Trading Economics

The price of gold has spiked to above the level found in the years following the 2007-08 global financial crisis, which raised a number of questions around the viability of sovereign debt. That gold has reached this level again suggests that investors remain wary.

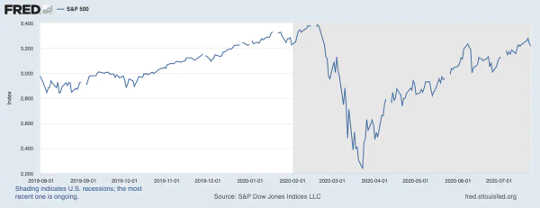

2. Stock markets

Stock prices fluctuate substantially and are typically regarded as being among the riskiest of investments. If a firm goes bankrupt then investors can lose all their money.

The S&P 500, one of the key stock indexes in the US, is below the level it started at this year but is above the level it was at this time last year. It is V-shaped, although the upstroke is a bit wobbly and continued uncertainty currently prevents a full recovery.

S&P 500. FRED

S&P 500. FRED

The view from some other markets, however, is less optimistic. For example, the UK’s major index, the FTSE 100, is still some way from recovering its pre-COVID position and has a slightly upward sloping L-shape.

FTSE 100. London Stock Exchange

FTSE 100. London Stock Exchange

3. Copper

Copper is the most widely used industrial metal. If goods are being made, and economies are expanding, then copper is in demand and the copper price will rise. Copper prices dropped at the start of the year when China was in lockdown. There was a further slump as coronavirus hit Europe and the US in March.

China is the world’s largest importer of copper and is responsible for almost 50% of global copper imports. So the price of copper is largely driven by demand from China and the increase in price from the lowest point around March 19 is consistent with the easing of the shutdown period in China. So the copper recovery shows signs of an elongated V-shape, perhaps stretching into a U.

Copper prices. London Metal Exchange

Copper prices. London Metal Exchange

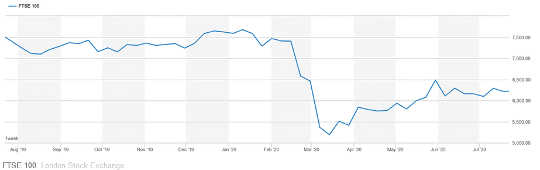

4. Baltic Dry Index

If goods are being made, they then need to be shipped to their final destination. The Baltic Dry Index is a composite index of the cost of shipping major raw materials. If goods are being shipped around the world from the manufacturer to the consumer then the index will rise.

Baltic Dry Index. Trading Economics

Baltic Dry Index. Trading Economics

This index is now not only above its initial US/European lockdown level, but has also returned to the levels it was at prior to China’s shutdown. This suggests a rise in manufacturing output and hope for exports. The dip at the end of the graph does signal a warning that uncertainty remains, however.

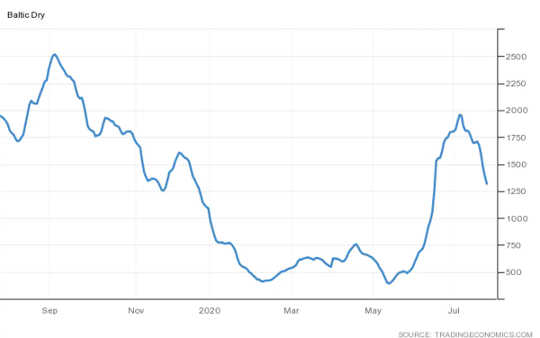

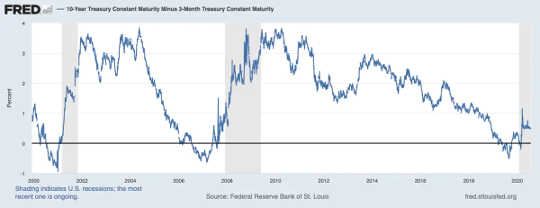

5. Government bonds

Like gold, another asset that’s seen as safer to invest in during crises is government bonds, given that governments (generally) do not go bankrupt and fail to repay their debts. When investors are nervous about future economic prospects, they buy government bonds, this then makes these bonds more expensive and reduces the yield that they pay (government bonds pay a fixed cash interest payment).

The yield on bonds is also affected by monetary policy operated by the central bank, with lower interest rates set in weaker economic climates to encourage people to spend. So, we can compare yields of different length bonds (known as the term structure), where a higher yield indicates a more positive outlook.

10-year Treasury constant maturity minus 3-month Treasury constant maturity. FRED

10-year Treasury constant maturity minus 3-month Treasury constant maturity. FRED

We can take a slightly longer time perspective and see from the graph above that, on the one hand, the upturn in the term structure indicates a recovery. But, on the other hand, the rise seems to have stalled indicating uncertainty going forward.

Overall, the evidence suggests that investors are unsure. That they are buying stocks and the goods used in production is a sign of hope that the global economy will recover quickly. But gold prices also give a dose of realism.

About The Author

David McMillan, Professor in Finance, University of Stirling

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Recommended books:

Capital in the Twenty-First Century

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.

Nature's Fortune: How Business and Society Thrive by Investing in Nature

by Mark R. Tercek and Jonathan S. Adams.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

Click here for more info and/or to order this book on Amazon.

Beyond Outrage: What has gone wrong with our economy and our democracy, and how to fix it -- by Robert B. Reich

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

Click here for more info or to order this book on Amazon.

This Changes Everything: Occupy Wall Street and the 99% Movement

by Sarah van Gelder and staff of YES! Magazine.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

Click here for more info and/or to order this book on Amazon.