Two key factors distinguish the economic consequences of coronavirus from those of previous crises. One is the catastrophic decline in employment in such a short space of time. The other is the incredibly swift digital transformation which has changed the way society works and consumes.

In this new digital landscape, as well as a widespread shift to home working, the resurgence of e-commerce and even the remote provision of healthcare have become facts of everyday life. In effect, the credit for the rapid digitising of most companies does not belong with business leaders – but to the arrival of Covid-19.

Any exit from the current lockdown is likely to reverse some of this digital transformation, but not all of it. And the unprecedented scale of what has happened will have a significant impact on employment levels for a long time – even as economies rebuild.

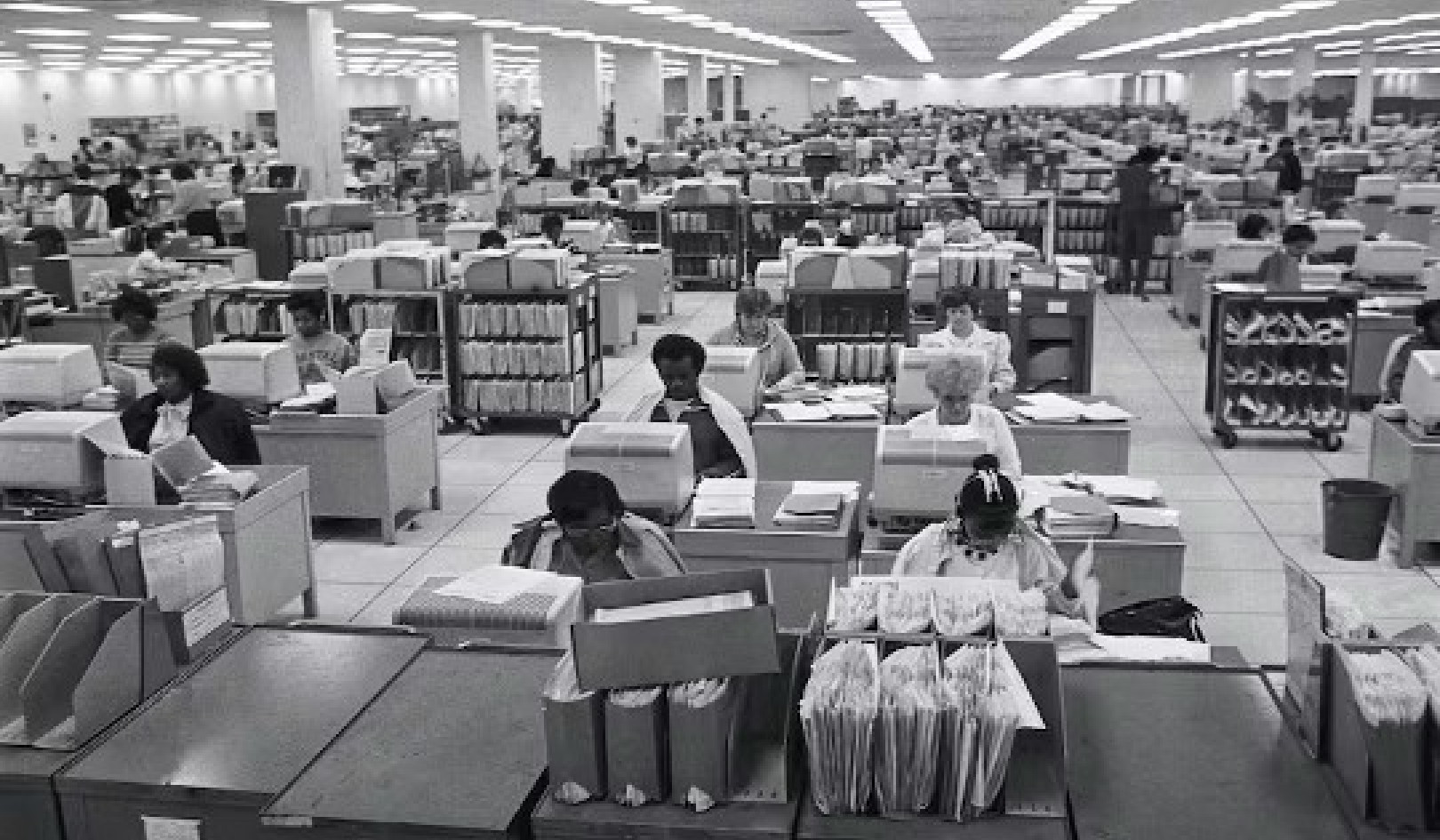

Indeed, weak employment growth has been a key feature of previous economic recoveries – a phenomenon economists call “jobless recovery”. In the US, following the global financial crisis of 2008, it took over six years for employment to get back to its pre-recession peak. The recessions of 1991 (after the Gulf War) and 2001 (the dot-com bubble crash), also saw long-lasting high levels of unemployment, with immense economic and social consequences.

In Europe, the effect on employment after 2008 was even more dramatic. It took the EU 11 years to return to its pre-crisis unemployment rate of 6.7%.

Recovery without jobs

Put simply, these jobless recoveries were caused by a mixture of globalisation and digitisation. Essentially, manufacturing jobs end up moving from advanced economies to destinations offering cheap labour, while advances in technology replace labour.

The vast scale of the digital transformation caused by coronavirus is likely to make any recovery even more jobless than in the past.

This leaves politicians with the difficult task of formulating policies that will counteract these unfavourable effects. They will need to come up with a plan that reverses the contraction in economic activity, reduces income inequality (or at least doesn’t worsen it) and minimises impact on government debt.

On that final point, it is worth mentioning that in the UK, national debt as a percentage of income is forecast to edge towards 100% – although some believe it be even higher. This figure was 75% in 2010 – and widely seen as unsustainable.

Our recent research has shown that there are trade-offs among these three objectives. For example, policies which stimulate the economy and reduce government debt often benefit business owners at the (relative) expense of workers. But policies which help the poorer in society have less of an impact on government debt as these households contribute less tax.

We also found that higher spending and lower taxes are particularly effective in economic downturns. This is because households tend to spend any additional earnings, helping the economy to bounce back faster.

Also, when interest rates are at record low levels, there is a potential for what we call “fiscal free lunches”. That is, tax cuts could raise income to such an extent that the additional tax revenue generated more than pays for any initial rise in government expenditure.

Time for the UK chancellor to make major changes. Shutterstock/Cubankite

Time for the UK chancellor to make major changes. Shutterstock/Cubankite

So policy looking to minimise the potential for a jobless recovery should look to increase production in the economy and increase the marginal returns from hiring labour.

For example, cuts to corporate tax rates can help by improving business profits, although cuts to employers’ national insurance contributions would be a more effective approach to directly addressing employment levels.

Also, while corporate tax cuts might end up increasing income inequality (by increasing dividends for shareholders) reducing national insurance contributions would increase demand for labour, raising both employment and wages. The government could also look to accelerate infrastructure spending, improving the productive capacity of the economy and providing a spending stimulus which targets long-term results.

Overall, the most significant impact on the economy and employment would come from a complete structural reform to tax and spending policy. In 2011 a comprehensive review of UK tax structure highlighted many inconsistencies and inefficiencies, concluding that the system was “inefficient, overly complex and frequently unfair”.

Since then, some small changes have been made, but these inefficiencies and complexities persist. If there was ever a good time to initiate truly bold reforms, it is now.![]()

About The Author

Gulcin Ozkan, Professor of Finance, King's College London; Dawid Trzeciakiewicz, Lecturer in Economics, Loughborough University, and Richard McManus, Director of Research Development, Senior Lecturer in Economics, Canterbury Christ Church University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Recommended books:

Capital in the Twenty-First Century

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.

Nature's Fortune: How Business and Society Thrive by Investing in Nature

by Mark R. Tercek and Jonathan S. Adams.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

Click here for more info and/or to order this book on Amazon.

Beyond Outrage: What has gone wrong with our economy and our democracy, and how to fix it -- by Robert B. Reich

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

Click here for more info or to order this book on Amazon.

This Changes Everything: Occupy Wall Street and the 99% Movement

by Sarah van Gelder and staff of YES! Magazine.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

Click here for more info and/or to order this book on Amazon.