The European Central Bank (ECB) has confirmed speculation that it will become the latest central bank to start raising headline interest rates to try to ward off inflation. The bank is to raise rates by 0.25 points to 0.25% for lending and -0.25% for deposits, with plans for another rise at the next meeting in September. It will also curtail its programme for buying the government bonds of countries like Italy and Greece by not increasing purchases every month overall.

All major economies are struggling with the difficulties of trying to deal with inflation by raising interest rates in the knowledge that it will drive up borrowing costs for consumers and businesses and potentially bring about a recession.

But for the eurozone, the situation is complicated by the fact that it has been propping up indebted countries who can’t deflate their currencies to get through economic turbulence. If the ECB now gets too tough on inflation, it could create a market panic that might revive the eurozone crisis of the 2010s.

Stagflation is back

The global outlook for inflation and global economic stability has significantly deteriorated in the last few months. In 2021 inflation headed upwards as global demand recovered after the pandemic but supply chains couldn’t keep up – not least because of China’s zero COVID policy. Rising energy prices were a major part of the problem.

Many central bankers thought this was temporary, and indeed when inflation started to ease in most developed economies in the second half of 2021, this seemed right. But the Russian invasion of Ukraine has both broken the decades-long peace in Europe, and brought three decades of a “great moderation” in prices to an end. Thanks to the extra pressure on oil and energy prices, inflation is many countries is now rising ahead of economic growth.

Inflation is also starting to weigh on the global economy in various ways. People have less money, so they can’t buy as much. And investors are more worried about the outlook, so they are more reluctant to invest. The prospects for global economic growth have significantly slowed since February. For example, the World Bank has just downgraded its forecast for the third time in six months, and currently predicts 2.9% growth in 2022.

The effect on government bonds

In view of this situation, investors have also been offloading corporate and government bonds. They fear that the prospects for debt defaults are higher than before, and the returns (yields) on bonds look even worse than before now that inflation is so high. Bond prices have duly been falling, which means that yields (interest rates) have been rising because they are inversely related.

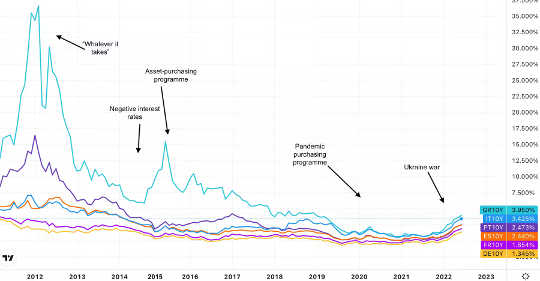

The yields on eurozone countries’ debt have been rising sharply, meaning it is becoming more expensive for them to borrow. Just like in the 2010s, the most pressure is on the countries whose public finances are the most unwieldy, such as Italy and Greece. But even Germany, which has been the bedrock of eurozone fiscal prudence and has enjoyed negative yields (also known as free borrowing) for most of the last three years, has also seen a significant rise.

Eurozone sovereign bond yields 2012-22

10-year bond yields: Germany = yellow; Greece = turquoise; Italy = blue; Portugal = indigo; France = purple; Spain = orange. Trading View

The eurozone crisis was caused in the early 2010s when investor fears about the solvency of Greece, Spain, Portugal and Ireland drove their bond yields to levels where they needed ECB support – otherwise, their debts would have become unmanageable and they would likely have had to exit the euro.

This support came in the form of loans; bond-buying programmes from the European Central Bank (ECB) to prop up prices; negative interest rates; “creating” euros via quantitative easing (QE); and reassurances from then president Mario Draghi that the ECB would do “whatever it takes” to prevent a collapse.

These measures are the main reason why bond yields have remained below ruinous levels since the 2010s, with bond-buying support and QE most recently provided early in the pandemic as countries had to borrow even more to cope. The ECB is currently sitting on government bonds from member states worth around €5 trillion (£4.3 trillion), and is currently making net purchases of over €30 billion a month.

Now that yields are surging again, one solution is for the ECB to buy even more bonds from these countries. However, it is not that simple because bond-buying underpinned by QE is another reason for inflation rising. Indeed, one of the other arguments in favour of these moves in the 2010s was to ward off deflation, which is not a valid justification now that inflation is so high. Bond-buying now would be a violation of the ECB’s strategy aiming for 2% inflation.

Were it to drive up inflation, that would make the economic outlook even worse. This could cause further sell-offs in bonds that would push yields higher.

Instead, the ECB is following the likes of the US Federal Reserve and Bank of England and doing the opposite. The danger with increasing interest rates and ending bond-buying is that it will hurt the economy, which could make investors more worried about the outlook and force bond yields even higher. Indeed, yields have just surged after the ECB signalled that it was potentially open to doing a 0.5 percentage points hike in rates in September, in a sign of how precarious this situation is.

In sum, the ECB is facing a strange dilemma, where every policy choice will potentially raise the risks of a repeat of the eurozone crisis of the 2010s. Inflation is a delicate business, which is why the Austrian economist Fridrich von Hayek compared it to trying to “catch a tiger by its tail”.

If inflation starts to fall as growth deteriorates, the eurozone may somehow avoid another crisis because it will then be easier to do more QE and buy more bonds. But in the meantime, all eyes will be on the bond yields of countries like Italy and Greece to see how high they rise.

About The Author

Muhammad Ali Nasir, Associate Professor in Economics, University of Leeds

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Recommended books:

Capital in the Twenty-First Century

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.

Nature's Fortune: How Business and Society Thrive by Investing in Nature

by Mark R. Tercek and Jonathan S. Adams.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

Click here for more info and/or to order this book on Amazon.

Beyond Outrage: What has gone wrong with our economy and our democracy, and how to fix it -- by Robert B. Reich

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

Click here for more info or to order this book on Amazon.

This Changes Everything: Occupy Wall Street and the 99% Movement

by Sarah van Gelder and staff of YES! Magazine.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

Click here for more info and/or to order this book on Amazon.