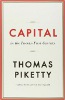

INNERSELF - Thomas Piketty's "Capital In The 21st Century" is certainly the the biggest economic book sold in this century, having reached # 1 book status on Amazon. It may also be the most important book. No doubt it will become the book some in the "money class" most love to hate.

Top 4 Radical Conclusions From Piketty’s “Capital In The 21st Century”

John Case, People's World - French political economist and author of "Capital In The 21st Century" Thomas Piketty is making a groundbreaking book tour of U.S. policy and academic centers armed with mounds of data that is shaking up economic prognosticators. Nearly every economist of any reputation must now deal with the stunning evidence behind the inequality trends Piketty illuminates. [Editor's Note: see video at the bottom of this page]

Even Robert Solow, Nobel Prize-winning economist, famed for discounting the dangers of excessive inequality over the "the long run" in market economies, was ready to dialog with Piketty at the Economic Policy Institute's forum this past week. His book, which draws on massive data retrieved from previously untapped tax reporting resources, is literally shaking the foundations of even liberal economic thinking because of four principal conclusions:

- Increasing concentration of wealth (primarily returns to capital) in the U.S. and Western Europe is returning to its historic dominance in the capitalist system after a brief 35-year period of relative shared prosperity. Economic surveys defining the "top" incomes as the top "20 percent" disguised the rate of concentration in recent years. When looking at the top 1 percent and higher the actual travesty of inequality is uncovered. Standard government economic data collection missed this. But tax records reveal it.

- The wealth of the 1 percent, and even more the .1 percent, is increasing at 2-3 times the overall growth rate of the economy (GDP). The median income worker, on the other hand, received virtually no gains from increased productivity. And workers who fall below median income have seen their share of national wealth and income dramatically cut.

- Concentration of wealth historically leads to concentration of political and institutional power, and concentration of political and institutional power leads to more concentration of wealth. This is a stunning conclusion, at least for many mainstream economists, who assumed more faith in automatic market stabilizers for imbalances in national income and wealth distribution.

But, there is a reason Piketty chose his book title to echo Karl Marx's classic work. One of his conclusions, and a central theme is: the abandonment of classic political economy (the interaction of economics and public institutions) by many professional economists in the academic and government communities in favor of very mathematical models, was, and is, a mistake. - Global capital is too strong and mobile now for any one country to regulate it. A global tax and redistribution mechanism must be in place to prevent inequality trends from tearing up not just individual nations, but sending the whole world into a hell not unlike the one that ended the last "Gilded Age" in 1912: World Wars I and II.

Piketty's thesis identifies the billionaires and the transnational corporations they control as the principal challenge. Without mentioning the word "socialism," he includes the little-mentioned but pervasive presence of Marx's Capital in the background,

In that sense he does, I believe, a great service: he establishes, in very close to scientific terms, the economic foundations of a profound democratic program that can unite nearly all working people, peoples of color and many national origins, men and women, young and old, professionals and small business. It is a foundation that unites the democratic outlooks of Benjamin Franklin, Martin Luther King Jr., Eugene Debs, Cesar Chavez, Mother Jones and Abraham Lincoln - even Elizabeth Warren, Barack Obama, Joseph Stieglitz and Sam Webb too!

Piketty is right, and it's simple to say: The returns to capital are too high; the returns to working people too low.

This article originally appeared on People's World

See further information on this topic (Bill Moyers video) below, as well as on Thomas Piketty's book.

About The Author

About The Author

John Case is a former electronics worker and union organizer with the United Electrical, Radio and Machine Workers (UE), also formerly a software developer, now host of the WSHC "Winners and Losers" radio program in Shepherdstown, W.Va.

What the 1% Don’t Want Us to Know

Moyers and Company - The median pay for the top 100 highest-paid CEOs at America’s publicly traded companies was a handsome $13.9 million in 2013. That’s a 9 percent increase from the previous year, according to a new Equilar pay study for The New York Times.

These types of jumps in executive compensation may have more of an effect on our widening income inequality than previously thought. A new book that’s the talk of academia and the media, Capital in the Twenty-First Century by Thomas Piketty, a 42-year-old who teaches at the Paris School of Economics, shows that two-thirds of America’s increase in income inequality over the past four decades is the result of steep raises given to the country’s highest earners.

{vimeo}92308666{/vimeo}

Recommended book:

Capital in the Twenty-First Century Hardcover

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.