I see Greg Mankiw used his NYT columnto tell folks that politicians are spinning tales when they say the economy is rigged. I would say that economists spin tales when they tell you it is not. (Mankiw and I just ran through this argument on a panel in Boston last week.) Let's quickly run through the main points.

First, the overall level of employment is a political decision. We would have many more people employed today if the deficit hawks had not seized control of fiscal policy back in 2011 and turned the dial toward austerity. The beneficiaries of higher employment are disproportionately those at the middle and bottom of the income distribution: people with less education and African Americans and Hispanics. So the politicians pushing austerity decided that millions of people at the middle and bottom would not have jobs.

Furthermore, in a weaker labor market, it is harder for those at the middle and bottom to get pay increases. So the shift to austerity also meant that tens of millions of workers would have to work for lower pay. Read all about it in my book with Jared Bernstein (free, and worth it).

The second way in which it is rigged is our trade policy. First there is the size of the trade deficit. This is the result of policy choices. Instead of forcing our trading partners to respect Bill Gates copyrights and Pfizer's patents, we could have insisted they raise the value of their currency to move towards more balanced trade. But Bill Gates and Pfizer have more power in setting trade policy than ordinary workers.

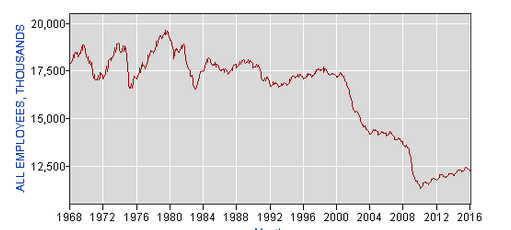

Also, contrary to what Mankiw tries to tell folks in his column, the trade deficit did play a big role in our loss of manufacturing jobs. As my favorite graph for the day shows, manufacturing employment was roughly constant at around 17,500 million from the late 1960s until 2000. During this period, there was substantial growth in manufacturing productivity, as Mankiw says. This growth caused manufacturing employment to decline as a share of total employment, but to remain roughly constant in absolute terms.

Manufacturing Employment

Source: Bureau of Labor Statistics.However, from 2000 to 2006 manufacturing employment falls by more than 3 million, or close to 20 percent. The change was the explosion in the size of the trade deficit, as an over-valued dollar made our goods less competitive. This plunge in employment devastated lives and whole communities. It was a clear policy choice. Importers like Walmart and outsourcers like GE benefited, as ordinary workers lost big-time.

Source: Bureau of Labor Statistics.However, from 2000 to 2006 manufacturing employment falls by more than 3 million, or close to 20 percent. The change was the explosion in the size of the trade deficit, as an over-valued dollar made our goods less competitive. This plunge in employment devastated lives and whole communities. It was a clear policy choice. Importers like Walmart and outsourcers like GE benefited, as ordinary workers lost big-time.

In addition to the volume of trade flows, there is also the content. We could be importing doctors, dentists, lawyers, and other highly trained professionals. This would mean writing trade agreements that made it as easy as possible for smart kids in foreign countries to train to our standards in these areas and then to work freely in the United States, just like people born in New York or California.

This would have lowered the wages of the most highly paid workers and reduced the prices that the rest of us have to pay for health care, dental work, and other high-priced professional services. We didn't go this route because highly paid professionals have more power than autoworkers and textile workers. (Yes, we can compensate developing countries so that they can train 2–3 professionals for every one that comes here — please don't show your ignorance by arguing the opposite in a comment.)

Then we have the financial sector. This has many of the richest people in the country who make their money fleecing the rest of us. It is wrong to say that the sector is deregulated, since it benefits from all sorts of government backstops, as we saw clearly in 2008–2009. We could downsize the sector, making it smaller and more efficient, with a financial transactions tax. Such a tax could free up more than $100 billion a year (@0.6 percent of GDP) for productive uses, while hugely reducing the incomes of the very rich.

Next we come to patent and copyright protection, both government granted monopolies that allow some folks to get very rich by charging the rest of us more money. This is most apparent with prescription drugs. A drug like Sovaldi carries a list price of $84,000 when it would sell in a free market for just a few hundred dollars per treatment. This rigging reflects the political power of the pharmaceutical, software, and entertainment industry. (Yes, there are other ways to finance drug development and creative work.)

Then we get to our broken corporate governance process that allows even failed CEOs like Carly Fiorina to walk away with over $100 million. The problem is that CEO pay is largely determined by their friends on the boards of directors. It is not determined by people who are asking whether they could get as good a CEO for less money. (Why try to take money from your friend?)

In Europe and Japan, CEOs are also well-paid, but they tend to get a third or a quarter of what our CEOs earn. This matters not only because of the pay the CEOs get, but also because of its impact on pay structures throughout the economy. It is now common to see top executives of non-profit hospitals, universities, or private charities get salaries of more than $1 million a year. They argue that they would get much more working for a corporation of the same size. And, this money comes out of the pockets of the rest of us.

So folks, the economy is rigged — better to believe the politicians than the economists.

About the Author

Dean Baker is co-director of the Center for Economic and Policy Research in Washington, DC. He is frequently cited in economics reporting in major media outlets, including the New York Times, Washington Post, CNN, CNBC, and National Public Radio. He writes a weekly column for the Guardian Unlimited (UK), the Huffington Post, TruthOut, and his blog, Beat the Press, features commentary on economic reporting. His analyses have appeared in many major publications, including the Atlantic Monthly, the Washington Post, the London Financial Times, and the New York Daily News. He received his Ph.D in economics from the University of Michigan.

Dean Baker is co-director of the Center for Economic and Policy Research in Washington, DC. He is frequently cited in economics reporting in major media outlets, including the New York Times, Washington Post, CNN, CNBC, and National Public Radio. He writes a weekly column for the Guardian Unlimited (UK), the Huffington Post, TruthOut, and his blog, Beat the Press, features commentary on economic reporting. His analyses have appeared in many major publications, including the Atlantic Monthly, the Washington Post, the London Financial Times, and the New York Daily News. He received his Ph.D in economics from the University of Michigan.

Recommended Books

Getting Back to Full Employment: A Better Bargain for Working People

by Jared Bernstein and Dean Baker.

This book is a follow-up to a book written a decade ago by the authors, The Benefits of Full Employment (Economic Policy Institute, 2003). It builds on the evidence presented in that book, showing that real wage growth for workers in the bottom half of the income scale is highly dependent on the overall rate of unemployment. In the late 1990s, when the United States saw its first sustained period of low unemployment in more than a quarter century, workers at the middle and bottom of the wage distribution were able to secure substantial gains in real wages.

This book is a follow-up to a book written a decade ago by the authors, The Benefits of Full Employment (Economic Policy Institute, 2003). It builds on the evidence presented in that book, showing that real wage growth for workers in the bottom half of the income scale is highly dependent on the overall rate of unemployment. In the late 1990s, when the United States saw its first sustained period of low unemployment in more than a quarter century, workers at the middle and bottom of the wage distribution were able to secure substantial gains in real wages.

Click here for more info and/or to order this book on Amazon.

The End of Loser Liberalism: Making Markets Progressive

by Dean Baker.

Progressives need a fundamentally new approach to politics. They have been losing not just because conservatives have so much more money and power, but also because they have accepted the conservatives' framing of political debates. They have accepted a framing where conservatives want market outcomes whereas liberals want the government to intervene to bring about outcomes that they consider fair. This puts liberals in the position of seeming to want to tax the winners to help the losers. This "loser liberalism" is bad policy and horrible politics. Progressives would be better off fighting battles over the structure of markets so that they don't redistribute income upward. This book describes some of the key areas where progressives can focus their efforts in restructuring the market so that more income flows to the bulk of the working population rather than just a small elite.

Progressives need a fundamentally new approach to politics. They have been losing not just because conservatives have so much more money and power, but also because they have accepted the conservatives' framing of political debates. They have accepted a framing where conservatives want market outcomes whereas liberals want the government to intervene to bring about outcomes that they consider fair. This puts liberals in the position of seeming to want to tax the winners to help the losers. This "loser liberalism" is bad policy and horrible politics. Progressives would be better off fighting battles over the structure of markets so that they don't redistribute income upward. This book describes some of the key areas where progressives can focus their efforts in restructuring the market so that more income flows to the bulk of the working population rather than just a small elite.

Click here for more info and/or to order this book on Amazon.

*These books are also available in digital format for "free" on Dean Baker's website, Beat the Press. Yea!