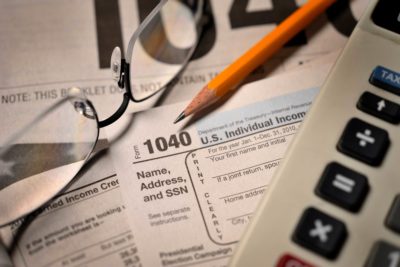

Knowing your income is just the first step to understanding how much you will be taxed. This guide will help you understand how the US tax system works, and where you fit into it.

What is a tax bracket?

The federal government taxes people based on how much they make each year. Seven tax brackets — based on income ranges — determine how much you pay:

Federal Tax Brackets by Adjusted Income

The rate that a single, nonmarried filer will pay for federal income tax.

| Tax rate | Single (not married) |

|---|---|

| 10% | 0 to $9,700 |

| 12% | $9,701 to $39,475 |

| 22% | $39,476 to $84,200 |

| 24% | $84,201 to $160,725 |

| 32% | $160,726 to $204,100 |

| 35% | $204,101 to $510,300 |

| 37% | $510,301 and above |

What are the filing categories for income tax brackets?

In addition to those brackets, there are four main categories, also known as “statuses,” that affect how you are taxed:

- Single filers — unmarried

- Married, filing jointly — couples filing together

- Married, filing separately

- Head of household — unmarried, live with a qualifying child

Together, the categories and brackets look like this:

Federal Tax Brackets by Adjusted Income

Income tax brackets for the different category of tax filers. NOTE: *Qualifying widows or widowers are their own category, with the same income brackets as those who are married and filing jointly.

| Tax rate | Single | Married, filing jointly* | Married, filing separately | Head of household |

|---|---|---|---|---|

| 10% | 0 to $9,700 | $0 to $19,400 | $0 to $9,700 | $0 to $13,850 |

| 12% | $9,701 to $39,475 | $19,401 to $78,950 | $9,701 to $39,475 | $13,851 to $52,850 |

| 22% | $39,476 to $84,200 | $78,951 to $168,400 | $39,476 to $84,200 | $52,851 to $84,200 |

| 24% | $84,201 to $160,725 | $168,401 to $321,450 | $84,201 to $160,725 | $84,201 to $160,700 |

| 32% | $160,726 to $204,100 | $321,451 to $408,200 | $160,726 to $204,100 | $160,701 to $204,100 |

| 35% | $204,101 to $510,300 | $408,201 to $612,350 | $204,101 to $306,175 | $204,101 to $510,300 |

| 37% | $510,301 and above | $612,351 and above | $306,176 and above | $510,301 and above |

So, how do tax brackets work?

If you look at the table above, you might assume that you are simply taxed at one flat rate for all of your income. But it’s more complicated than that.

The U.S. has what’s called a progressive tax system. What that really means is the amount you get taxed progresses with the amount of money you make — even within the tax brackets outlined above.

Example: Let’s say as a single filer, you bring in a taxable income of $20,000. You would fall into the 12% tax bracket, but you wouldn’t simply be taxed 12%. Instead, you would get taxed at the lowest rate for the first $9,700 you make and at higher rates for the money you make above that.

In other words, you would be taxed in two different tax brackets: $0 to $9,700 and $9,701to $39,475. For the first $9,700 you make, you are only taxed 10%. The remaining $10,300 you make is taxed at the next tax bracket level of 12%. So you would owe $970 for the first bracket and $1,236 for the second bracket.

What are the differences between state and federal tax brackets?

The above chart shows federal income tax brackets. There are also separate state tax brackets. Each state has its own rules, but they generally tax income at lower rates than the federal government. Most states have a progressive tax structure similar to the federal one. There are some exceptions though.

Seven states do not tax income at all:

- Alaska

- Florida

- Nevada

- Texas

- South Dakota

- Washington

- Wyoming

Tennessee and New Hampshire don’t tax income from wages but do tax some income from investments.

Nine states tax income at one flat rate, no matter how much you make:

- Colorado

- Illinois

- Indiana

- Kentucky

- Massachusetts

- Michigan

- North Carolina

- Pennsylvania

- Utah

What tax bracket am I in?

To determine your tax bracket, you need to know your taxable income in 2019. This involves figuring out two things: your income and your tax deductions.

- Income: Essentially all income is taxable income. This includes your salary, wages, tips, any payment for freelance work, sales from real estate and more. (It also includes capital gains, which can be taxed at different rates depending on whether or not they are short or long term, and what your income is).

- Tax deductions: A tax deduction is an amount of money that’s subtracted from your total income, therefore lowering the amount of tax you have to pay.

Once you’ve determined your total income, you can generally subtract any deductions to arrive at your taxable income. See the chart above to find out where it places you.

What is the standard deduction?

The most-used tax deduction is the standard deduction, which is a no-questions-asked amount that you can subtract from your income, lowering the total amount of taxes you have to pay. Before claiming the standard deduction, make sure you understand the rules — for example, you can’t deduct home mortgage interest if you are also claiming the standard deduction.

Example: Let’s take a single person whose only income is from their salary of $32,000. If they only take the standard $12,200 deduction, they will have a taxable income of roughly $20,000. That means they’ll fall into the 12% bracket.

What is an IRS tax audit?

An IRS audit is a review of a person’s tax filing by an IRS official to make sure everything was done correctly. Sometimes, you’ll be chosen randomly, but usually something or someone will make your return stand out, and it will be flagged for an audit. If you’re being audited, you will find out via mail — never over the phone.

You might also hear from the IRS via a tax notice, which is usually less serious and could be for any number of reasons, like verifying your identity, increasing or decreasing your tax return amount.

How far back can the IRS audit?

The IRS generally includes the past three filing years in a tax audit. However, the agency can look further back if it identifies a major error. Typically it does not look back further than six years.

Who gets audited?

The IRS audits taxpayers with household income between $50,000 and $100,000 the least.

As ProPublica has reported, the IRS has seen its budget slashed year over year, and its ability to audit the wealthy and corporations has also suffered. These days, the top-earning 1% of taxpayers are audited at about the same rate as those who claim the earned income tax credit (EITC), a group that has an average household income of $20,000 a year.

A recent analysis found that a rural county in the Mississippi Delta was the highest-audited county in America, despite the fact that more than a third of its mostly African-American population is below the poverty line. Also, the five counties with the highest audit rates are all predominantly African American, rural counties in the Deep South.

“Those struggling to make ends meet are being unfairly audited while the fortunate few dodge taxes without consequence,” Sen. Ron Wyden, D-Ore., the ranking member on the Senate Finance Committee, told ProPublica in 2018.

This article originally appeared on ProPublica

Remember Your Future

on the 3rd of November

Learn about the issues and what's at stake in the November 3, 2020 US Presidential election.

Too soon? Don't bet on it. Forces are conniving to stop you from having a say in your future.

This is the big one and this election may be for ALL the marbles. Turn away at your peril.

Only You Can Prevent 'Future' Theft

Follow InnerSelf.com's

"Remember Your Future" coverage

Books on Inequality from Amazon's Best Sellers list

"Caste: The Origins of Our Discontents"

by Isabel Wilkerson

In this book, Isabel Wilkerson examines the history of caste systems in societies around the world, including in the United States. The book explores the impact of caste on individuals and society, and offers a framework for understanding and addressing inequality.

Click for more info or to order

"The Color of Law: A Forgotten History of How Our Government Segregated America"

by Richard Rothstein

In this book, Richard Rothstein explores the history of government policies that created and reinforced racial segregation in the United States. The book examines the impact of these policies on individuals and communities, and offers a call to action for addressing ongoing inequality.

Click for more info or to order

"The Sum of Us: What Racism Costs Everyone and How We Can Prosper Together"

by Heather McGhee

In this book, Heather McGhee explores the economic and social costs of racism, and offers a vision for a more equitable and prosperous society. The book includes stories of individuals and communities who have challenged inequality, as well as practical solutions for creating a more inclusive society.

Click for more info or to order

"The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy"

by Stephanie Kelton

In this book, Stephanie Kelton challenges conventional ideas about government spending and the national deficit, and offers a new framework for understanding economic policy. The book includes practical solutions for addressing inequality and creating a more equitable economy.

Click for more info or to order

"The New Jim Crow: Mass Incarceration in the Age of Colorblindness"

by Michelle Alexander

In this book, Michelle Alexander explores the ways in which the criminal justice system perpetuates racial inequality and discrimination, particularly against Black Americans. The book includes a historical analysis of the system and its impact, as well as a call to action for reform.